Having served in the metals industry for 30 years, I am sorry to report the precious metals marketplace is broken. It has become saturated with companies with multi-million-dollar operating budgets, all with one common goal: selling precious metals for a profit.

There is nothing wrong with that, but this is where the problems begin. The day after making a purchase, the average precious metals investor is upside down by a whopping 10%—30%! If the market price goes lower, that number will increase.

A question new bullion investors rarely ask: If I buy from you today, how much will you pay me if I sell it back tomorrow? We believe this is a question that matters. The bullion investor must understand all benefits and pitfalls when buying gold and silver bullion.

Consider the following:

The only way to make money with your metals is to sell at a higher price than you paid, which, in a sense, is counterintuitive. The metals market can be volatile and is controlled by institution-level market makers. Other geo-political circumstances can come into play here. Your money is tied up and pays no income, interest, or dividends. On the other hand, the demand for metals as a safe haven asset is unprecedented.

Private Bullion has made the decision to advocate for the bullion investor. Our enthusiasm for helping people who want to protect their assets with precious metals will be evident once you decide to become a Private Bullion member.

Solution:

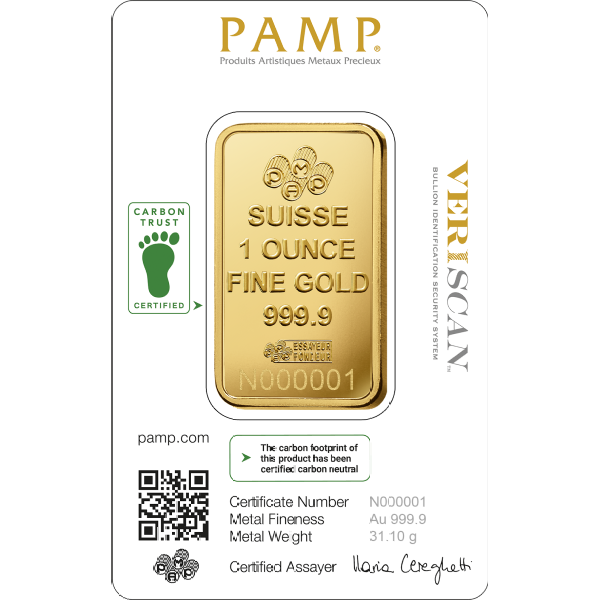

We are pleased to announce a revolutionary member program that may save you and your family thousands! It is now possible to Buy Precious Metals at Dealer Cost! With the membership, you can buy unlimited gold, silver, and pre-1933 coins at dealers’ cost for an entire year!

Why the Precious Metals Marketplace is Booming:

- Investors are looking for assets that have historically held their value in turbulent times, particularly geo-political tensions and economic uncertainty.

- Precious metals are regarded as safe-haven assets and act as a store of value when fiat currencies and other assets falter.

- Institutions and central banks have become more interested in precious metals. This interest improves market liquidity and visibility.

- Technological advancements are broadening awareness and demographic growth across the board.

- Investors are concerned about the health of the US dollar and inflation and consider gold and silver bullion a safe alternative.

- The formation of a new digital currency (CBDC) to replace the US dollar has left tens of millions of Americans concerned about the future value of their retirement portfolios.

- American trust in the US Government, Wall Street, and our banks are at an all-time low.

The precious metals industry, more importantly, the investors it serves, is long overdue for the type of company we endeavor to create.

Stop paying high-retail for your gold and silver coins and bars, Buy Precious Metals at Dealer Cost!

Cheers!

Scott Hage

President & CEO

PrivateBullion.com